In simple term compound interest is interest on interest. This means, compound interest is the interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan.

For example, if you deposit Rs 100 into your saving bank account @ 10% compound interest rate per year, in the first year you get Rs 10 as interest. In the second year, when interest is calculated it will be on the new balance of Rs 110 (i.e. 100+10) not on the principle amount of Rs 100. In the third year, interest will be calculated on Rs 121 (i.e. 110+11).

Calculation will be complex if you want to calculate future value for more than 10 years. To simplify the calculation, we have a formula which can be used to get the end result easily.

You can also find out the time period required at a particular compound interest rate to double your money.

Compounding interest Formula

FV = PV * (1+i) n

FV= Future Value of the Investment

PV = Present Value of the Investment

i = interest rate

n = number of time period

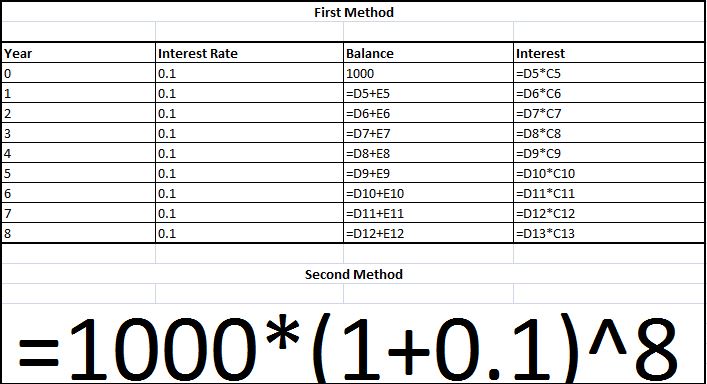

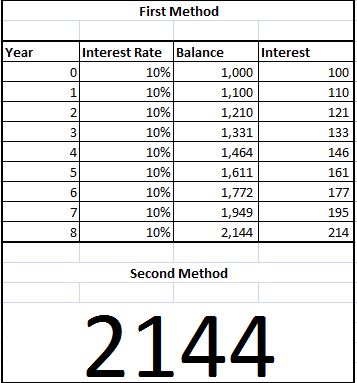

Compound interest calculation by using excel

Formula

Result

Rule of 72 for compound interest

Instead of using the above compound interest formula, you can use rule of 72 to easily figure out how long it takes your money to double.

Rule of 72 is a math rule which allow investors to quickly and efficiently answer two questions;

- How long will it takes to double your money @ X% compound interest

- What returns you must earn if wish to double your money in X number of years

Let us understand rule of 72 with an example;

If you can earn 10% return on your investment and wants to know how long it takes to double your money then by using rule of 72, you need to divide number 72 with the rate of return of 10. Your result will be 7.2.

This means, it takes 7.2 years @10% compound interest rate to double your money.

To get answer for the second question, i.e. what returns should you get to double your return in X number of year, you need to reverse you calculation.

For instance, if you want to double your money in 7 years time, then simply divide the magical number 72 with 7. Your result will be 10.285. This means, at 10.285% compound interest rate, you can double your money in 4 years time.

Does the Rule of 72 Always Work?

Rule of 72 is used to estimate the time it takes to double an investment. Rule of 72 will give you accurate results only when interest rate is between 6 % to 10 %.

If you move to larger interest rates then the approximation gets worse. For instance, when interest rate is 72%, rule of 72 says that you will get your money double in the first year itself (i.e. 72/72). But at 72% interest rate, you only earn 72% of the principal amount, which means it does not actually double your money.