You are eligible to income tax refund if the amount of tax paid exceeds the actual tax liability for a previous year. This type of situation arises when you have paid advance tax during the financial year expecting a higher income or TDS has been deducted from your receipts even though you are not liable to tax .

In case of salary employee, if your employer has deducted 1, 20,000 rupees as tax from your salary instead of the actual deduction of 1, 00,000 rupees then you are eligible for 20, 000 rupees as tax refund from IT department.

To claim such refund you have to follow the procedures as laid down by IT department.

If you are working as an insurance agent or collection agent where the person making payment to you has deducted tax to which you are not eligible, then you can claim the entire amount deducted as refund from IT department.

How tax refund process work

You need to file your IT return with the IT department either online. After filling your IT return, department will verify the details and process your return if it fits the criteria of getting refund.

Refund will be either issued to your bank account provided at the time of filling your IT return or a cheque will be dispatched to your mailing address provided in the IT return.

How to file tax refund

To get income tax refund, you need to submit your return of income showing the actual tax liability against TDS or TCS amount that has already been deducted from your income and deposited to your PAN. You are not required to claim it separately. After filing your ITR, refund if any will be granted to you by the government.

Before filling your IT return you must register your PAN with IT department online. So register your pan and get your password for it. Here are the steps for IT refund filling;

- Visit IT efiling website

- Login with your PAN as user id and the chosen password.

- Download IT return from that is applicable to you.

- Fill up the form with all correct details like bank account number, IFSC code, PAN number and other details.

- Double check the refund amount reflecting in your IT return.

- Upload your IT return by using the upload option at the site.

- E-verify your IT return after uploading it.

- In case its not possible to e-verify, take print out of the acknowledgement generated from such filling and send the IT return acknowledgment (ITRV) to IT department’s Bangalore office.

How to check refund status online

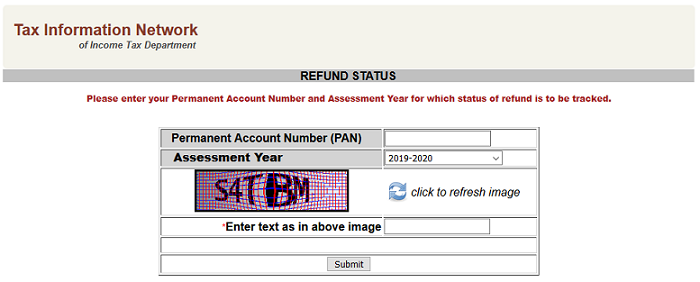

IT Refund status can be viewed online either using your form 26AS form or by getting in to the NSDL site. You need not login to income tax site or any other site to view your IT refund. Just by entering the PAN number and assessment year you can view the IT refund status.

You can follow below steps to know your income tax refund status;

- Go to NSDL Site’s refund status page.

- Down below the screen you will have two fields to enter. In the first place you are required to enter the permanent account number of the person for whom you want to see the status online.

- After entering the PAN or permanent account number, select the assessment year for which you have applied for a refund.

- Click On submit button

Now you will be displayed with the status i.e. the mode of payment, reference number, date of refund and status with remarks.

Please remember, you are required to type the PAN number in capital letter. If you type in small letters, then it will give you an error message like “invalid pan”.

If no results are displayed for you, then your income tax refund has not yet been processed by IT department. You may check after a week to know the exact status as it takes a week time to get updated.

There can be many reasons for denying income tax refund. In case of delay, you can raise a re-issue request online by which it will be re-issued to your bank account.

We have listed few possible reasons for your reference;

- Bank details such as account number and IFSC code is not correct.

- Mismatch between form 26AS and details filed in IT return.

- Details such as BSR code, date of payment and challan numbers are not filled up correctly in IT return.

- Already a tax demand exist in the name of taxpayer.

- You have not e-verified the IT return or ITR V has not yet been received at CPC Bangalore office in case you haven’t e-verified.

If total income of the assessee includes income of another person, then he is entitled to refund in respect of such clubbed income. In case of death of a person, his legal representative or trustee or guardian shall be entitled to claim such refund.

The amount to be refunded can be set off against the sum payable by the assessee after sending intimation in writing. The set-off arising against the tax payable shall be done by using the details of outstanding tax demand if such demand or refund is greater than Rs. 5000.

If your income tax refund is pending for a long time then contact your assessing officer immediately. You can take professional help from a chartered accountant or advocate to help you in this matter.

You can also drop email to [email protected] for more details on IT refund status.

How to get faster tax refund

To get faster IT refund you need to do following things;

- Compare your form 16/16A with the online form 26AS to know the details of income tax that has been deducted and deposited in your PAN.

- Provide your correct mailing address, Operational Bank Account Number and IFSC code of your bank branch.

- File your correct IT return online.

- Submit your ITR-V within 120 days of filling your IT return, if you have not e-verified online.

- Check your refund status regularly. You can also check your bank account to know if the amount has been deposited or not.

For speedy process of IT refund we suggest you to file your IT return online.

Interest payable on refund

Interest at the rate of 0.5% per month or part of the month on the refund amount will be paid to the assessee. Any fraction of a month shall be deemed to be a full month and interest shall be so calculated.

The period for calculation of interest is based on filing of return of income and mode of tax payment.

Where refund is out of any tax deducted or paid by way of TDS or TCS or advance tax, interest shall be calculated for the following periods;

- If return of income is filed on or before the due date of filing, then interest has to be calculated for the period starting from 1st April of the assessment year to the date on which the refund is granted.

- Where return of income is not filed on or before the due date, interest has to be calculated from the date of furnishing return of income to the date on which refund is granted.

Where refund is out of any self-assessment tax paid under section 140A, period has to be calculated from date of furnishing return or payment of tax whichever is later to the date on which refund is granted.

No interest shall be payable if the amount to be refunded is less than 10% of the tax determined under section 143(1) or on regular assessment.

For the purpose of computing interest, the income tax shall be rounded off to the nearest multiple of Rs 100 and for this purpose any fraction of Rs 100 shall be ignored.

Please remember, interest received on the refund amount is taxable under the head Income from other sources.

Time Limit to get refund

If you forgot to claim refund by filing return of income then it can be claimed by filing Form 30 within one year form the last day of the relevant assessment year.

Delay in filing the claim may be condoned by the assessing officer. However, no claim under this provision will be entertained where a period of more than 6 years from the end of the relevant assessment year has elapsed.

After filing return of income, if you are not getting refund, then it’s always advised to check your status online to know the reason of delay. After logging into your account, you can see the status under the tab my account > my return/ form.

Or else, you can check it at NSDL site.

In case, you forgot to claim IT refund while filing your IT return, you can get your IT refund by applying in form 30 to the IT department.