Form 26AS is a very essential document for filing IT return. When you pay income tax at the end or in between the financial year against your Permanent account number (PAN), it automatically gets reflected in a statement maintained by the IT department known as Form 26AS or Income Tax Credit Statement.

If someone else like employer or bank or any other party, has deposited tax deducted out of your payments (TDS) on your behalf for instance deducted tax from salary or any other payments, then that amount also gets reflected in Form 26AS or Credit Statement. It’s reflected after filing TDS statement 24Q or 26Q against your PAN.

In other words, 26AS is an annual statement maintained by the income tax department disclosing the details of the tax credit in the account of the assessee. The tax credit will cover the following;

- TDS

- TCS

- advance tax

- self-assessment tax

- payment of tax on regular assessment

- Special financial transaction information

Now you know, what does form 26AS show?

Today, In this article we will show you how to view your income tax credit statement in form 26AS online.

26AS has different sections, each section will show you details of the tax amount deducted, refunded and deposited, the party who has deducted it, date of deduction, date of deposit.

You can compare it with your TDS certificates received. The total amount that gets credited to your account can also be seen here.

How can I check my 26AS details online – Tax credit statement

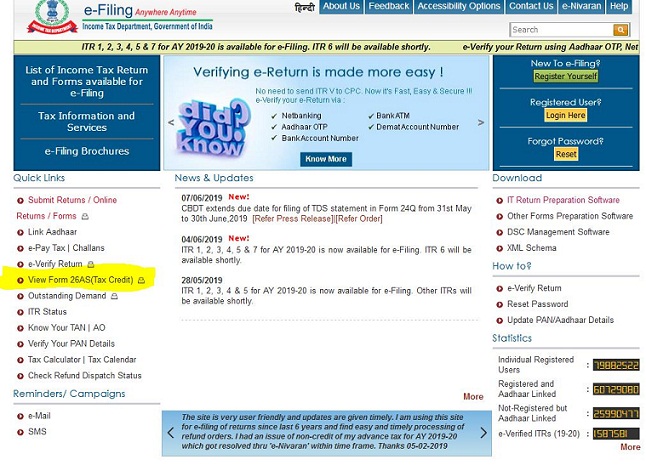

To get form 26AS, you need to visit https://incometaxindiaefiling.gov.in/. Look for the “View Form 26AS” option. To view details of the tax credit, click on that link as shown in the below image.

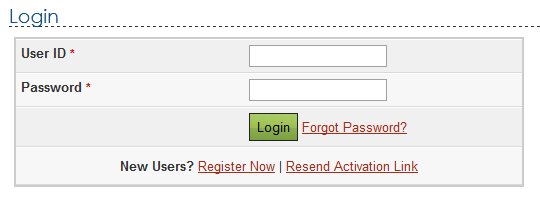

It will ask you to enter your login ID and Password. Enter your login Id as PAN number, and password then click on the submit button.

If you do not have user id and password then you need to generate one by registering yourself with the IT department. To do that you can see the “sign up” section there.

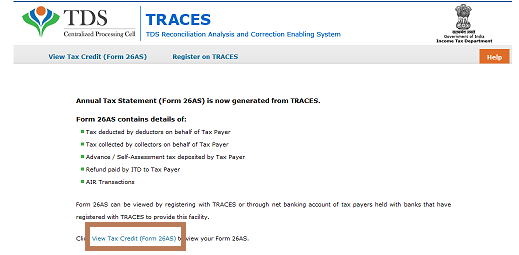

Confirmation to view 26AS will be asked after logging in. Once you have confirmed, the system will take you directly to the form.

In between, you may be asked to confirm certain messages. Please accept or confirm those and then click on the “View Tax Credit (Form 26AS)” option down below the screen.

A different window will be popped up asking you to confirm if you want to view tax credit.

You can also view your tax credit by clicking on “View Tax Credit (Form 26AS)” on the top available option or down below available option

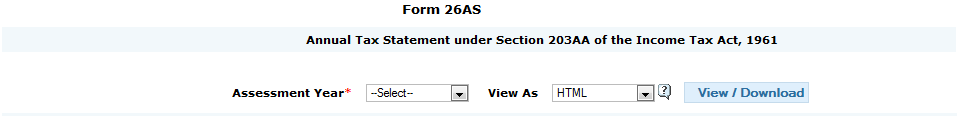

From the drop-down, select your assessment year and file type to view or download 26AS.

As per the department, you also have the option to view the Income-tax credit statement from your bank’s net-banking account. You need to log-in to the following bank’s net banking account where you can view Form 26AS option.

- Axis

- BOI

- Citi

- Corporation

- IDBI

- Indian Bank

- Kotak Mahindra

- SBI

- State Bank of Travancore

- The Federal Bank Limited

- UCO

- Bank of Baroda

- Bank of Maharashtra

- City Union Bank Limited

- ICICI

- IOB

- Karnataka Bank

- OBC

- State Bank of Mysore

- State Bank of Patiala

- The Saraswat Co-operative Bank Limited

- UBI