In Budget for the year 2015-16, Indian Government has announced the introduction of universal social security schemes in the Insurance and Pension sectors for all Indians, especially for the poor and the under-privileged. In our previous article we have discussed about Pradhan Mantri Suraksha Bima Yojana and Pradhan Mantri Jeevan Jyoti Bima Yojana.

One of the scheme that is introduced by Modi Government in Budget for the year 2015-2016 is Atal Pension Yojana or APY.

Atal Pension Yojana will provide a defined pension depending on the contribution and its period.

APY is a Government of India Scheme, which is administered by the Pension Fund Regulatory and Development Authority.

Atal Pension Yojana or APY is open to all bank account holders.

The minimum age of joining Atal Pension Yojana or APY is 18 years and maximum age is 40 years. Therefore, minimum period of contribution by any subscriber under APY would be 20 years or more. The age of exit and start of pension would be 60 years.

All eligible persons having bank saving account may join Atal Pension Yojana or APY with auto-debit facility to bank accounts.

The subscribers are required to opt for a monthly pension from Rs 1000 – Rs 5000 and ensure payment of stipulated monthly contribution regularly.

The subscribers can opt to decrease or increase pension amount during the course of accumulation phase, as per the available monthly pension amounts. However, the switching option shall be provided once in year during the month of April.

Each subscriber will be provided with an acknowledgement slip after joining Atal Pension Yojana scheme which would invariably record the guaranteed pension amount, due date of contribution payment, PRAN etc

Atal Pension Yojana is guaranteed by the Government

The benefit of minimum pension under Atal Pension Yojana would be guaranteed by the Government in the sense that if the actual realised returns on the pension contributions are less than the assumed returns, for minimum guaranteed pension, over the period of contribution, such shortfall shall be funded by the Government.

On the other hand, if the actual returns on the pension contributions are higher than the assumed returns for minimum guaranteed pension, over the period of contribution, such excess shall be credited to the subscriber’s account, resulting in enhanced scheme benefits to the subscribers.

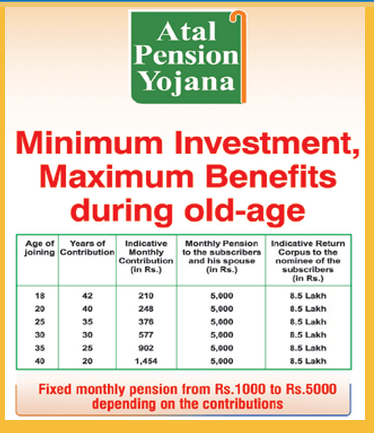

Table showing contribution levels and fixed monthly pension to subscribers

Under the APY or Atal Pension Yojana, the subscribers would receive a fixed minimum pension amount of Rs 1000 per month or Rs 2000 per month or Rs 3000 per month or Rs 4000 per month or Rs 5000 per month at the age of 60 years, depending on the contributions, which itself would be based on the age of joining the APY.

| Age of Joining | Years of Contribution | Indicative Monthly Contribution(in Rs.) | Monthly Pension to the subscribers and his spouse (in Rs.) | Indicative Return of Corpus to the nominee of the subscribers (in Rs.) |

| 18 | 42 | 42 | 1000 | 1.7 lakhs |

| 20 | 40 | 50 | 1000 | 1.7 lakhs |

| 25 | 35 | 76 | 1000 | 1.7 lakhs |

| 30 | 30 | 116 | 1000 | 1.7 lakhs |

| 35 | 25 | 181 | 1000 | 1.7 lakhs |

| 40 | 20 | 291 | 1000 | 1.7 lakhs |

| Age of Joining | Years of Contribution | Indicative Monthly Contribution(in Rs.) | Monthly Pension to the subscribers and his spouse (in Rs.) | Indicative Return of Corpus to the nominee of the subscribers (in Rs.) |

| 18 | 42 | 84 | 2000 | 3.4 lakhs |

| 20 | 40 | 100 | 2000 | 3.4 lakhs |

| 25 | 35 | 151 | 2000 | 3.4 lakhs |

| 30 | 30 | 231 | 2000 | 3.4 lakhs |

| 35 | 25 | 362 | 2000 | 3.4 lakhs |

| 40 | 20 | 582 | 2000 | 3.4 lakhs |

| Age of Joining | Years of Contribution | Indicative Monthly Contribution(in Rs.) | Monthly Pension to the subscribers and his spouse (in Rs.) | Indicative Return of Corpus to the nominee of the subscribers (in Rs.) |

| 18 | 42 | 126 | 3000 | 5.1 lakh |

| 20 | 40 | 150 | 3000 | 5.1 lakh |

| 25 | 35 | 226 | 3000 | 5.1 lakh |

| 30 | 30 | 347 | 3000 | 5.1 lakh |

| 35 | 25 | 534 | 3000 | 5.1 lakh |

| 40 | 20 | 873 | 3000 | 5.1 lakh |

| Age of Joining | Years of Contribution | Indicative Monthly Contribution(in Rs.) | Monthly Pension to the subscribers and his spouse (in Rs.) | Indicative Return of Corpus to the nominee of the subscribers (in Rs.) |

| 18 | 42 | 168 | 4000 | 6.8 Lakh |

| 20 | 40 | 198 | 4000 | 6.8 Lakh |

| 25 | 35 | 301 | 4000 | 6.8 Lakh |

| 30 | 30 | 462 | 4000 | 6.8 Lakh |

| 35 | 25 | 722 | 4000 | 6.8 Lakh |

| 40 | 20 | 1164 | 4000 | 6.8 Lakh |

| Age of Joining | Years of Contribution | Indicative Monthly Contribution(in Rs.) | Monthly Pension to the subscribers and his spouse (in Rs.) | Indicative Return of Corpus to the nominee of the subscribers (in Rs.) |

| 18 | 42 | 210 | 5000 | 8.5 Lakhs |

| 20 | 40 | 248 | 5000 | 8.5 Lakhs |

| 25 | 35 | 376 | 5000 | 8.5 Lakhs |

| 30 | 30 | 577 | 5000 | 8.5 Lakhs |

| 35 | 25 | 902 | 5000 | 8.5 Lakhs |

| 40 | 20 | 1454 | 5000 | 8.5 Lakhs |

Contribution from Central Government

The Central Government would also co-contribute 50% of the total contribution or Rs. 1000 per annum, whichever is lower, to each eligible subscriber account, for a period of 5 years, i.e., from Financial Year 2015-16 to 2019-20, who join the NPS before 31st December, 2015 and who are not members of any statutory social security scheme and who are not income tax payers.

However, the scheme will continue after this date but Government Co-contribution will not be available.

Government would also reimburse the promotional and development activities including incentive to the contribution collection agencies to encourage people to join the APY.

Penalty for default in payment to Atal Pension Yojana Scheme

The subscribers should keep the required balance in their savings bank accounts on the stipulated due dates to avoid any late payment penalty. Due dates for monthly contribution payment is arrived based on the deposit of first contribution amount. In case of repeated defaults for specified period, the account is liable for foreclosure and the Government of India co-contributions, if any shall be forfeited.

Also any false declaration about investor’s eligibility for benefits under Atal Pension Yojana scheme for whatsoever reason, the entire government contribution shall be forfeited along with the penal interest.

As per the scheme requirements, investor is required to make the contribution on a monthly basis. In case of delay in payments, banks are required to collect additional amount which will vary from Rs 1 per month to Rs 10 per month.

Table showing penal charges calculated based on contributions per month.

| Penal charges | Contributions |

| Rs. 1 per month | for contribution upto Rs. 100 per month

|

| Rs. 2 per month | for contribution upto Rs. 101 to 500/- per month |

| Rs. 5 per month | for contribution between Rs 501/- to 1000/- per month |

| Rs. 10 per month | for contribution beyond Rs 1001/- per month |

The fixed amount of interest/penalty will remain as part of the pension corpus of the subscriber.

Investor’s account will be frozen if payments are discontinued for 6 months, deactivated if payments are discontinued for 12 months and closed if discontinuance is for 24 months.

As and when funds are available, the due amount along with fixed charges will be recovered by the banks.

While applying for Atal Pension Yojana, investors are requested to give or update correct mobile numbers as periodical information to the subscribers regarding balance in the account, contribution credits etc. will be intimated to APY subscribers by way of SMS alerts.

When investor can Exist Atal Pension Yojana

Investors can exit the scheme and start drawing the guaranteed monthly pension only upon completion of 60 years of age. For drawing the guaranteed monthly pension subscriber is required to submit the request to the associated bank.

Exit before 60 years of age is permitted only in exceptional circumstances, i.e., in the event of the death of beneficiary or terminal disease.

Dear Sir,

You didn’t covered the details about death in the payment period i.e. before 60 years? What will get the nominee/ spouce? If any pension received to spouce of the policy holder or total corpus will be paid to spouce or nominee in case of death of the policy holder?

Please update.