Charitable trusts in India are set up for social causes. To get tax exemption these registered charitable trusts are required get their trust registered with income tax department and follow tax regulations as prescribed in India.

As per Income Tax Act, 1961, charitable trusts in India are required to file income tax return before the due date as prescribed in the Act. Today, we will be discussing when a charitable trust is required to file income tax return and before which date charitable trusts are required to file income tax report i.e. due date of filing income tax return.

As per section 139(4C) of income tax act, a charitable trust is required to file income tax return if total income before allowing exemption under section 11 and 12 exceeds the basic exemption limit that is chargeable to tax in India for the relevant financial year for which the charitable trust is filing income tax return.

For assessment year 2014-2015 i.e. financial year 2013-2014, basic exemption limit is Rs. 250000. Without giving effect to exemptions available under section 11 and 12 of income tax act, if income of charitable trust exceeds 250000 rupees then the charitable trust is required to file their income tax return.

As per income tax Act, where assessee is a person other than company and accounts are required to be audited under any law then income tax return has to be filed on or before 30th September of the relevant assessment year. As charitable trusts are required to get their accounts audited, its income tax return filing due date is 30th September of the relevant assessment year.

This means for assessment year 2015-2016 i.e. financial year 2014-2015, income tax return filing due date is 30th September 2015. Similarly for next financial year 2015-2016 or assessment year 2016-2017, due date of filing income tax return for charitable trust will be 30th September 2016.

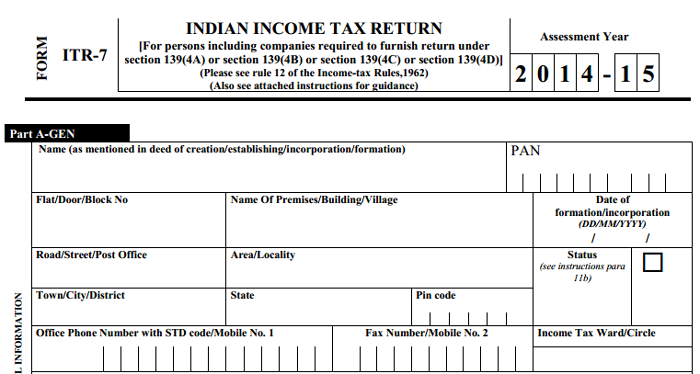

Charitable trusts are required to file income tax return before the due date is form ITR7 in paper format.

Charitable trust which fails to furnish its income tax return within the due date of filing can still submit it’s IT return any time before the expiry of 1 year from the end of the relevant assessment year or before the completion of the assessment year which ever is earlier.

For instance, a charitable trust is required to file its income tax return for assessment year 2015-2016 on or before 30th September 2015. If this due date is missed then income tax return can still be filed on or before 31st march of 2017 i.e. 1 year from the end of assessment year 2015-2016.

hello,

does a charitable trust having having income of Rs. 7000/- in a year before claiming exemption under section 11 & 12 , need to file a return of income..