Income tax payments can be done online by a person who is having net banking facilities in any approved bank like HDFC, SBI, and ICICI, etc. If you do not have net banking account then you can use your friend’s, relative’s or any other individual’s bank account for payment of your tax.

However, while paying, you have to enter your own Permanent Account Number or PAN of the person on whose behalf tax payments are made.

You can not pay income tax online by using a credit card. At present, this facility is not available. We hope the government will enable this facility so that an individual can use this mode of payment in the future.

One can follow below steps for payment of income tax or deposit of TDS.

Keep your Net Banking login details ready

Before preparing for the e-payment of tax, you need to check your mode of payment first. If you have a net banking facility then keep your account ID and password ready to enter when the system asked for it.

Following banks are authorized for e-payment ;

- Allahabad

- Andhra

- Axis

- BOB

- BIO

- BOM

- Canara

- CBI

- Corporation

- Dena

- HDFC

- ICICI

- IDBI

- Indian Bank

- IOB

- J&K

- OBC

- Punjab and Sind

- PNB

- State Bank of Bikaner & Jaipur, Hyderabad, Mysore, Patiala, Travancore

- SBI

- Syndicate

- UCO

- UBI

- United Bank of India

- Vijaya

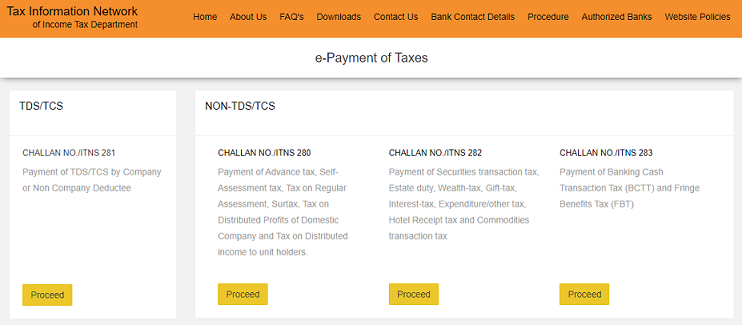

Select Challan for payment

You need to select the relevant challan as applicable to you to fill up details.

After filling up, the challan will have an online check for PAN/TAN validity. After validating the details, it will allow you to make payments.

For this reason, before payment, you need to double-check your details shown on the challan.

Here are the challans available for e-payment of tax. You need to choose the one that suits your need.

| Challan No. | Applicable to |

| 281 | TDS / TCS from corporate or non-corporate |

| 280 | Payment of income or corporate tax |

| 282 | Payment of Security Transaction, Hotel Receipts , Estate Duty, Interest, Wealth, Expenditure/Other direct & Gift tax |

| 283 | Payment of Banking Cash Transaction and Fringe Benefits |

| 26QB | Payment of TDS on sale of property |

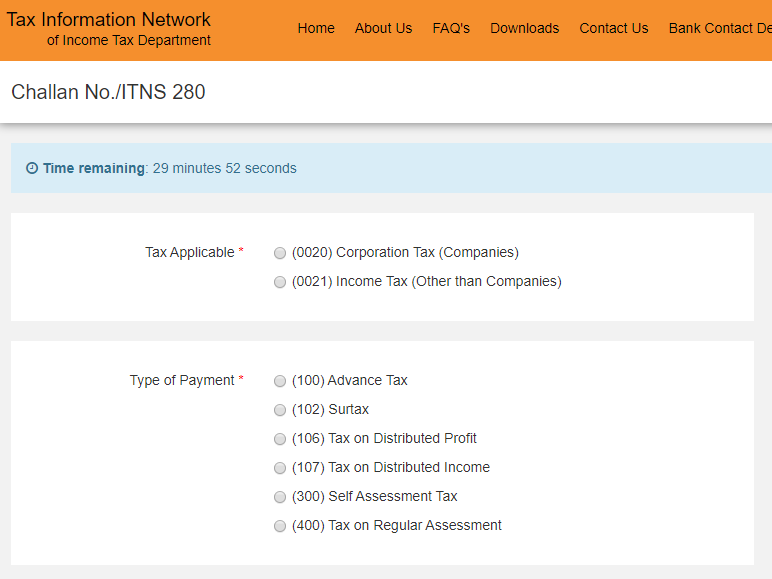

We use challan 280 for payment of self assessment or advance tax.

Fill up PAN and Payment Details in Challan

On submission of the challan, the form will be asking for a confirmation of the details that you entered. After confirmation, the system will take you to the net banking site that you have selected at the beginning.

Please make sure that the PAN number and assessment year has been filled up correctly. On confirmation, the form will display the PAN holder name for you to cross-check whether payment details. If the PAN holder name displayed is matching with your details available, then proceed for payment.

Pay income tax online

You need to login to your selected bank’s net banking account with user ID and password to pay income tax online.

On successful payment, a counterfoil will be generated with the details of making payment. Have that counterfoil as proof of payment. While making payment make sure to mention tax and interest amount separately.

Details in the acknowledgment copy such as BSR code of the bank, date of payment, Serial number of the challan and amount paid will be required while filing IT return.