Currency Exchange rate is the price of the currency on a particular date. It’s like price of potatoes in a super market. For instance, if potatoes are selling at the price of 5 per one INR then we can take INR to potato exchange rate as 5.

This means by giving one Indian rupees we get 5 numbers of potatoes. Similarly, potatoes to INR exchange rate will be 1/5. This means by selling one potato we get 20 paisa.

Based on the market rates of different currencies, exchange rates are defined with respect to INR. We need to know currency exchange rates of other nations like USA, UK, Germany, France, Japan, China and Itally based on the country we are traveling to.

One country’s currency are not always accepted in another country except in European countries where countries like france, germany, italy and netherland accept EURO as one currency. In 2002, EURO became the single currency of 12 countries that have formed the European Union.

Foreign exchange conversion means exchange of currencies. For example, one party having X amount of currency say INR wants to have USD for his foreign travel to USA. To get USD, he will offer INR to either an authorized bank or foreign exchange dealer to buy at the other party’s buying rate to get equal value of USD. This particular event is called Foreign Exchange conversion of INR to USD.

In India, only authorized dealers can buy and sell foreign currencies. So to buy or sell your foreign currencies, you need to either visit an authorized bank like HDFC, AXIS, KOTAK and SBI or to an authorized dealer.

If someone said you that in India USD rate is 63.60 then it means you have to pay Rs 63.60 to buy one USD. If the requirement is for 1000 USD then you need to pay Rs 63600 to the authorized bank or dealer.

Foreign currency exchange rates are dependent on so many factors like supply and demand, foreign investments, import and export ratios, inflation and other economic factors. Every day market use to define these rates based on above factors.

What is Buy and Sell rate in Foreign Exchange Conversions?

Where ever you go for conversion of local currencies to foreign currency or forex to local currency, you need to know two rates that the authorized bank or dealer offers.

One is buy rate and the other one is sell rate. Some bankers use it as Bank Buy and Bank Sell. Some other bankers and dealers use it as We Buy and We Sell.

Buy rate means the rate which authorized dealer or bank offers to buy foreign currency in exchange of local currency. This means, if you have 100 USD now and you want to get it converted to INR or to your home county currency then the authorized bank or dealer will use buy rate to pay you in INR or in local currency. If the buy rate is Rs 63 then in exchange of 1000 USD, you will get Rs 63000.

Sell rate is the rate at which authorized bank or dealer sells foreign currency in exchange of local currency. For example, if you are heading to USA and require 1000 USD then authorized bank or dealer will use that day’s sell rate to get the foreign currency of 1000 USD converted to INR. If that day’s USD sell rate is Rs 65 then you need to pay Rs 65000 to get 1000 USD.

You will always find the bank’s or dealer’s sell rate as higher than buy rate, as the difference between both rates will be their profit.

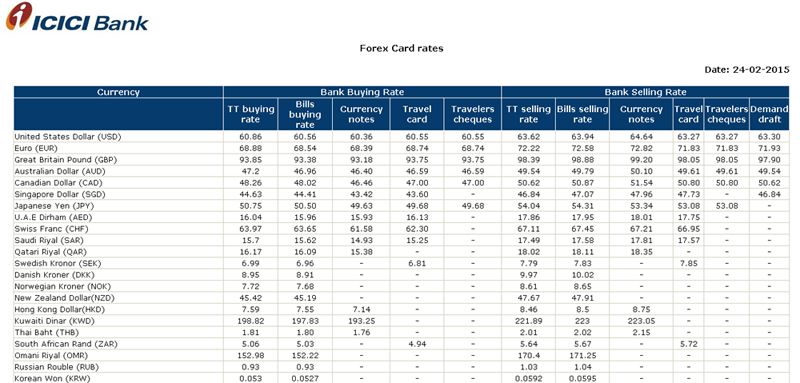

Here is ICICI bank’s Buying and selling rates for different foreign currencies on 24th February 2015 for your reference;

Now a day’s private banks like ICICI are offering to buy forex online to get it delivered at customer’s doorstep. Even one can use his net banking account to load foreign currency to prepaid travel card, which then can be used in foreign countries.