Employees are required to provide a declaration at the beginning of the financial year or at the time of joining the organization showing proposed investments and expenses eligible for tax deductions.

At this point, you are not required to submit actual proofs of investment and expenditure.

Based on this declaration, employer is required to deduct tax (i.e. known as TDS) every month from employee’s salary and deposit it to the government account on or before the due date.

At the quarter and year end, deposited tax has to be assigned to respective PAN of the employee by filing TDS return with the tax department.

Employer after filing TDS return for the year will be able raise a request for downloading Form-16.

To know the exact amount that employee has invested or spent, the employee is required to provide all supporting investments and expenses proof to the employer at the end of the financial year. Employer’s tax calculation will be based on these declarations and submission of evidence.

Actual investments don’t have to be exactly as declared before. It can be less or more than the declared amount.

Before 1st June 2016, there was no proper standard format for taking details of investment and expenditures from employee to claim tax deductions.

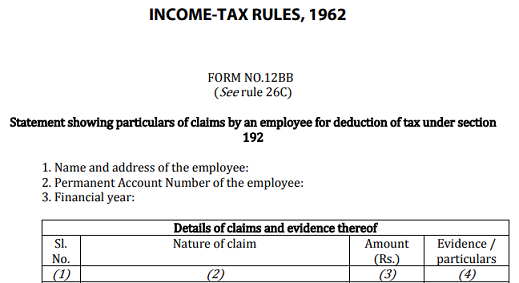

For this reason, CBDT vide notification no 30/2016 has prescribed form 12BB as a standard format to be used by the employee as a statement showing investment and expenses details for the purpose of estimating income or computing tax deduction at source.

Form 12BB has to be submitted by the employee to the employer.

As per this notification with effect from 1st June 2016, employees are required to submit new form 12BB to the employer with details of investment and expenditure to claim income tax deduction from salary.

Form 12BB is required to be submitted at the end of the financial year.

As per form 12BB, following details are required to be submitted to employer with documentary evidence;

House rent allowance

In the case of house rent allowance or HRA, the employee is required to provide Rent receipt with details of land lord like name, address and the amount paid towards rent in form 12BB.

In addition to these details, PAN of the landlord is also required to be produced in form 12BB if aggregate rent paid for the year exceeds Rs 1 Lakh.

Leave travel allowance or LTA

In the case of Leave travel allowance, the tax department is asking to provide evidence of expenditure in form 12BB.

Any claim towards LTA has to be submitted with all documentary evidence.

Interest Payments on Home Loan

Deduction of interest under the head income from house property can be claimed with details like name, address and permanent account number of the lender.

You can submit interest certificate received from bank or financial institution from whom loan has been taken along with form 12BB as evidence.

Income Tax Deduction under chapter VIA

In the case of tax deductions, employees are required to provide the amount to be claimed under different sections and documentary evidence like insurance premium receipt, investment receipt to the employer along with form 12BB.

Under section 80C, if you have different investments and expenses then that has to be shown separately in form 12BB with evidence details.

Download from 12BB to know more link