As per sub section 3 of Section 92 of Companies Act 2013, an extract of the annual return in such form as may be prescribed shall form part of the company’s board’s report.

This means, from financial year 2014-2015 onward, the extract of the annual return shall form part of the Board’s report instead of balance sheet as provided in earlier old Companies Act 1956.

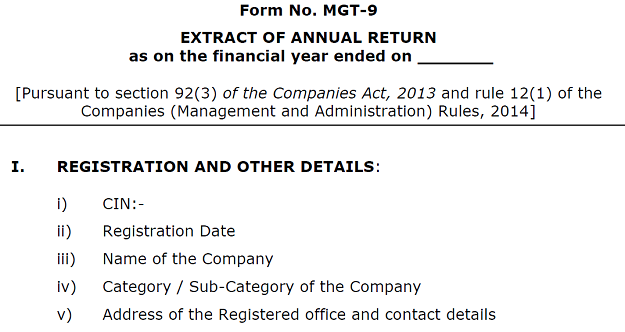

Rule 12 of The Companies (Management and Administration) Rules, 2014 further said that the extract of the annual return to be attached with the company’s board’s report shall be in form MGT9.

As per the specified format of form MGT9 following details are required to be given in specified manner as an attachment to Director’s report from financial year 2014-2015 on-wards;

- Registration and other details like CIN, Registration Date, Company Name, Address of the registered office, whether listed or not.

- Principal business activities of the company.

- Particulars Of Holding, Subsidiary And Associate Companies.

- Share Holding Pattern (Equity Share Capital Breakup As Percentage Of Total Equity). In this case further break up is required based on Category-wise Share Holding, Shareholding of Promoters, Change in Promoters’ Shareholding ( please specify, if there is no change), Shareholding Pattern of top ten Shareholders (other than Directors, Promoters and Holders of GDRs and ADRs) and Shareholding of Directors and Key Managerial Personnel.

- Indebtedness of the Company including interest outstanding/accrued but not due for payment.

- Remuneration Of Managing Directors, Directors and/or Manager, And Key Managerial Personnel.

- Penalties / Punishment/ Compounding Of Offences.

Please remember, it is an extract of the annual report. Figures of the company’s annual return to be filed with ROC in Form MGT7 should match with the figures of Form MGT9.

Signing of the extract of Annual Return – MGT9

As per section 134(6) of Companies Act, 2013, the extract of the Annual Return, which shall be the part of the Board’s Report shall be signed by the Chairperson of the company, if he is authorized by the Board to do so, or where he is not so authorized, by at least two directors, one of whom shall be a managing director, or by the director where there is one director.

If the company contravenes the provision of section 134, the company shall be punishable with fine which shall not be less than 50, 0000 rupees but which may extend to 25,00,000 rupees and every officer of the company who is in default shall be punishable with imprisonment for a term which may extend to 3 years or with fine which shall not be less than 50, 0000 rupees but which may extend to 5,00,000 rupees, or with both.(Section 134(8))

Format of the Form MGT9 Can be found at MCA site (click this link to download).