Business units taking registration under GST law, will be provided a unique identification number known as Goods and Services Tax Identification Number or GSTIN. Its also referred as GST number. This number consists of 15 unique alpha numeric digits issued by the government in response to the application filed by the person.

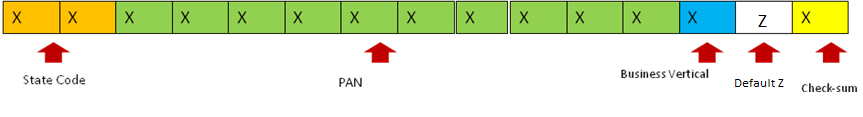

Out of the 15 unique alpha numeric number of GSTIN, first two numbers will represent the state in which you have taken GST registration. Next 10 digits will be the PAN of the taxpayer given by income tax department. Out of the last three, first one (i.e. 13th digit) indicates the number of registrations an entity has within a state for the same PAN, next one (i.e. 14th digit) by default is Z and the last one is check-sum digit used to detect errors.

As per GST law, every person who is liable to be registered shall apply for registration in every such State or Union territory in which he is so liable within 30 days from the date on which he becomes liable to registration, in such manner and subject to such conditions as may be prescribed.

A casual taxable person or non-resident taxable person shall apply for registration at least 5 days prior to the commencement of business.

Every person who makes a supply from the territorial waters of India shall obtain registration in the coastal State or Union territory where the nearest point of the appropriate baseline is located.

Can more than one GSTIN be taken in India

For each state, separate registration is required if the person applying for registration makes the taxable supply in more than one state. This means GSTIN obtained in one state will not be used in other states to supply taxable goods and/or services. This means separate GST registration has to be obtained in each such state where the person is making taxable supplies.

As per GST law, a person having multiple business verticals in a State may obtain a separate registration for each business vertical, subject to such conditions as may be prescribed.

A person who has obtained or is required to obtain more than one registration, whether in one State or Union territory or more than one State or Union territory shall, in respect of each such registration, be treated as distinct persons for the purposes of GST law.

If more than one GST has been issued for a taxpayer with same PAN in one state then the 13th digit of the GSTIN will be changed accordingly.

For example; if a person has a single registration in one state the 13 digit of the GSTIN allotted will be 1. If the same person wants another registration within the same state then the 13th digit of GSTIN assigned will become 2. When the number of registration is 10, instead of mentioning 10, A will be replaced to state that it’s the 10th registration. Similarly, for 11th and 12th registration, letter B and C will be used. In this way, a business with same PAN can get up to 35 registrations within a state.

State codes used according to Indian Census 2011. Here is the list of state codes used in GSTIN;

| State Code | State Name |

| 01 | Jammu & Kashmir |

| 02 | Himachal Pradesh |

| 03 | Punjab |

| 04 | Chandigarh |

| 05 | Uttranchal |

| 06 | Haryana |

| 07 | Delhi |

| 08 | Rajasthan |

| 09 | Uttar Pradesh |

| 10 | Bihar |

| 11 | Sikkim |

| 12 | Arunachal Pradesh |

| 13 | Nagaland |

| 14 | Manipur |

| 15 | Mizoram |

| 16 | Tripura |

| 17 | Meghalaya |

| 18 | Assam |

| 19 | West Bengal |

| 20 | Jharkhand |

| 21 | Orissa |

| 22 | Chhattisgarh |

| 23 | Madhya Pradesh |

| 24 | Gujarat |

| 25 | Daman & Diu |

| 26 | Dadra & Nagar Haveli |

| 27 | Maharashtra |

| 28 | Andhra Pradesh |

| 29 | Karnataka |

| 30 | Goa |

| 31 | Lakshdweep |

| 32 | Kerala |

| 33 | Tamil Nadu |

| 34 | Pondicherry |

| 35 | Andaman & Nicobar Islands |

Important points on GSTIN – Goods and Services Tax Identification Number

- Supplier of the business need to quote their own GSTIN correctly in GST invoice in addition to the customer’s GSTIN.

- In all official communication and places of business GSTIN must be mentioned.

- Supplier should not charge tax or claim input tax credit without registration or before obtaining GSTIN.