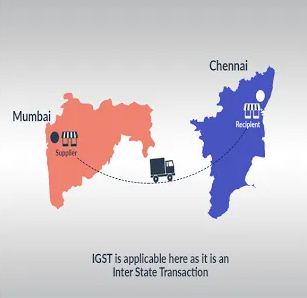

GST law clearly says when supplies of goods and/or services shall be treated as in the course of inter-state trade/commerce and when it should be treated as in the course of intra-state trade/commerce. This differentiation is important as based on it, GST will be levied.

As per section 7 of the IGST Act, a supply of goods and/or services will be treated as a supply in the course of inter-state trade or commerce, if the location of the supplier and the place of supply are in –

- two different states; or

- two different Union territories; or

- a state and union territory

Supply of goods imported into the territory of India, till they cross the customs frontiers of India, shall be treated to be a supply of goods in the course of inter-state trade or commerce.

In the case of services, if it’s imported into the territory of India, then it shall be treated to be a supply of services in the course of inter-state trade or commerce.

As per section 2(11)of the IGST Act, the term import of services means the supply of service where the supplier is located outside India, the recipient is located in India, and the place of supply of service is in India.

In following cases, the supply of goods or services or both shall be treated in the course of interstate trade or commerce under section 7(5):-

- Supplier is located in India and the place of supply is outside India;

- supply is to a special economic zone developer or a special economic zone; or

- supply is by a special economic zone developer or a special economic zone; or

- in the taxable territory, not being an intra-state supply and not covered elsewhere in this section.

If you analyze, section 7 of the IGST Act, you will find that the section talks about two types of supplies-

- Supplies within India

- Supplies from outside India

In case supplies are within India, then it will be considered as interstate supplies if-

- you supply goods and/or services to a different state or Union territory within India.

- You supply goods and/or services to a SEZ developer or SEZ unit

- You are a SEZ developer or your office is in a SEZ unit.

In case supplies are from outside India, then it will be considered as inter-state supply of goods and/or services if-

- You bring goods into India from a place outside India and they cross the customs frontier of India.

- You received services in the territory of India from a supplier who is located outside India.

What is SEZ

A special economic zone or SEZ is a geographical zone where the economic laws relating to import and export are liberal as compared to other parts of India. For GST and all other purposes, SEZ unit will be considered as a zone or place which is outside India.

The place of supply to/from SEZ unit or developer is irrelevant for the purpose of GST. Any supply to/from these SEZ units or developers are treated as inter-state supply.

Rate of GST on inter-state supplies

In the case of inter-state supplies, integrated goods and services tax (IGST) is to be levied on the transaction value under section 15 of CGST Act. This means IGST is levied when supplies of goods and/or services are;

- to a different state; or

- to a Union territory; or

- to a SEZ unit; or

- to a SEZ developer.

On following items IGST will not be charged even if its inter-state supplies;

- Alcoholic liquor for human consumption (its outside the purview of GST law)

- Petroleum crude

- High speed diesel

- Motor spirit/Petrol

- Natural gas and

- Aviation turbine fuel

In addition to inter-state supplies, IGST is also charged on imported goods and/or services.

GST law has notified the following six rates of CGST for goods. SGST or UTGST is leviable at the equivalent rate based on the place of supply. In the case of inter-state supplies, the government has notified equal amounts of CGST and SGST/UTGST as IGST.

- 0.125%

- 1.5%

- 2.5%

- 6%

- 9%

- 14%

In the case of services, 2.5%, 6%, 9%, and 14% are notified as CGST based on the type of services you render. An equivalent amount of SGST/UTGST is also levied in addition to CGST.

For instance, in the case of services not falling under any specific heading are taxed at the rate of 18%, out of which 9% is CGST and 9% is SGST/UTGST.

In the case of interstate supplies, 5%, 12%, 18%, and 28% have been notified as rates to be charged as IGST. Similarly, in the case of Goods transport agencies, the prescribed GST rate is 5% (2.5% as CGST and 2.5% as SGST/UTGST) in case input tax credit has not been taken.