You must be nervous like any other investors while deciding whether or not to enter the stock market. Therefore, it’s always better to explore the market to know who are the big fishes in the stock market and how they work.

Below in this article we have listed the world’s most successful investors. You must spend time learning from these masters.

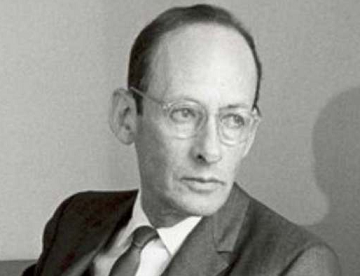

Benjamin Graham

Benjamin Graham was a British-born American economist, professor, author and investor. He is universally recognized as the father of value investing. He believes in fundamental analysis to pick stocks.

You might have heard about the book “the intelligent investor”. Benjamin Graham is the author of two best seller books “the intelligent investor” and “security analysis”.

Legendary investor Warren Buffet, called the intelligent investors as “by far the best book on investing ever written”.

Benjamin Graham’s views on value investing helped to shape the strategies of a generation of value investors including legendary investor Warren Buffett, Chairman and CEO of Berkshire Hathaway.

He used financial analysis to successfully invest in stocks. He made a lot of money for himself and for his clients.

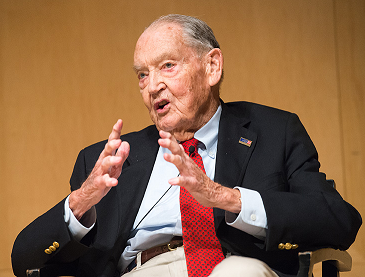

Warren Buffett

For stock market investors, Warren Buffet is the ultimate role model. He is the world’s richest person, consistently ranking high on forbe’s list of billionaires.

Warren Buffet’s success in the stock market is based on fundamental analysis. He is popularly known as the “Oracle of Omaha”.

You can learn more about Warren Buffett’s style of investing by reading his letters to shareholders or books available in the market. The most notable book is The Warren Buffett Way published by Wiley.

Warren Buffett combined both Graham and Fisher’s philosophy of investing to his style of stock picking.

Buffett’s ability to buy-and-hold fundamentally undervalued stocks at the right time has helped him to become one of the richest people in the world. Duration, consistency and magnitude of the exceptional returns are literally unmatched.

Charlie Munger

Charles Thomas Munger is an American billionaire investor, businessman and vice chairman of Berkshire Hathaway. Warren Buffett has described Munger as his partner.

Here are two of his best quotes:

“Spend each day trying to be a little wiser than you were when you woke up. Discharge your duties faithfully and well. Systematically you get ahead, but not necessarily in fast spurts. Nevertheless, you build discipline by preparing for fast spurts. Slug it out one inch at a time, day by day. At the end of the day – if you live long enough – most people get what they deserve.”

“Take a simple idea, and take it seriously.”

Peter Lynch

Peter Lynch has managed the Fidelity Magellan Fund for 13 years. He is considered as one of the best mutual fund managers in the USA. During his tenure, he took the fund from an asset of $18 million to more than $14 billion.

Peter Lynch penned thress classic investing books, “One Up On Wall Street”, “Beating the Street” and “Learn to Earn”.

Philip Fisher

Philip Fisher is known as the father of investing in growth stocks. He was the owner of Fisher & Company until his retirement in 1999 at the age of 91. For stock picking he focused on management characteristics, excellent financial control, high profit margin, high return on capital, industry position and other characteristics of business.

His book “common stocks and uncommon profits” discusses the characteristics of superior companies and how to identify them. He emphasizes growth investing.

John Templeton

John Templeton founded the investment fund Templeton Growth limited in 1954. He sold his various templeton funds in 1992 to the Franklin group for $440 million.

He is termed as “arguably the greatest global stock picker of the century” by money magazine (january 1999).

George Soros

He is famous for running his Quantum Fund. During his tenure in the quantum fund, he managed to generate an average annual return of more than 30%.

George Soros is most commonly known as the man who “broke the bank of england”. In 1992, George Soros shorted the British Pound. On that single trade, he made over 1 billion US dollar.

John (Jack) Bogle

John “Jack” Bogle founded the Vanguard Group in 1974. Today it operates about 170 funds with more than $2 trillion in assets under management.

Under John Bogle’s leadership, Vanguard group grew to be the second largest mutual fund company in the world. He believes in putting money into low cost index funds that have low commission and very little turnover of assets.

I hope you enjoyed the list of most successful investors. You need to learn more about them to gain some insights into how the very best of the best made their money.

Remember, you need to invest based on your own research not by what others tell you to buy and sell.

You will not make money if you decide your stock picking based on what headlines suggest you in financial papers, magazines and TV channels. You should not base your decision of buying and selling on the basis of what your neighbor, friends or relatives tell you.

We will suggest you learn all the basics of the stock market and develop your own investment style. You should also take interest to know how the greatest investors have made money in the stock market.

Disclaimer: In addition to the disclaimer below, please note, this article is not intended to provide investing or trading advice. Trading in the stock market and in other securities entails varying degrees of risk, and can result in loss of capital. Most investors and traders lose money. Readers seeking to engage in trading and/or investing should seek out extensive education on the topic and help of professionals. This article contains affiliate links to products. We may receive a commission for purchases made through these links. However, this does not impact our reviews and comparisons. We only suggest products we’ve reviewed, and in many instances also use, in order to help you make the best choices.