The main purpose of a price chart in technical analysis is to show how buyers (bulls) and sellers (bears) are competing over a certain period. One of the most effective and widely used methods to display this battle is through candlestick charts.

In this article, we will introduce you to several key aspects of candlestick chart techniques that have contributed to its popularity as one of the most widely used charting methods in technical analysis.

In technical analysis, the goal of a chartist isn’t just to look at past data, but to try to predict future market movements.

The goal is that if you can predict price movements accurately most of the time, you can make profitable investments and trades. In this context, candlestick charts can be a valuable tool to help you forecast market trends.

By studying price action on past candlestick charts, traders can predict small movements in the market and use this information to make profitable trades.

It’s important to remember that past performance does not guarantee future results. So, while analyzing candlestick charts, you must also consider the overall market trends when making trading decisions.

For success, traders need easy-to-read charts that help them make quick choices and analyze patterns efficiently. Candlestick charts provide these advantages.

If you’re new to candlestick charts, we’ve covered the basics of how they are formed in a previous article. Feel free to refer to it for more detailed information. In this article, we’ll explore why many successful traders, both new and experienced, prefer using candlestick charts for trading.

Why Use Candlestick Charts?

There are many reasons why traders prefer using candlestick charts for both short-term and long-term trading in the financial market. Here are the key reasons why these charts are so popular among professional traders:

Flexibility

Candlestick charts are highly flexible and can be used alongside other technical indicators or on their own. Unlike point and figure charts, which can’t be combined with other indicators, candlestick charts offer more versatility.

When used with other leading indicators, such as support, resistance, RSI, Stochastics, MACD, and moving averages, you can easily identify complex patterns to predict the next market move.

These charts can be applied to both short-term and long-term trades, making them suitable for any trading style. Almost all charting software now provides intraday charts, including 1-minute, 2-minute, 3-minute, 5-minute, 10-minute, 15-minute, and hourly charts.

Additionally, candlestick charts can be used in various markets, such as stocks, futures, options, currencies, and commodities, allowing you to trade in virtually any market worldwide.

Pictorial-Instant recognition

Candlestick charts are highly visual and offer an instant way to understand trader psychology compared to other types of charts. By observing the formation of various candlestick patterns and the price data, traders can quickly interpret market conditions and make informed trading decisions.

You can easily understand the trader psychology behind each candlestick by comparing one candle to the previous ones. This helps interpret any changes in market sentiment, providing valuable insights for making decisions to buy, sell, or hold.

By looking at the size, location, and color of the candle, you can quickly gauge the psychology of market participants. For instance, a large candle suggests strong momentum behind the price move.

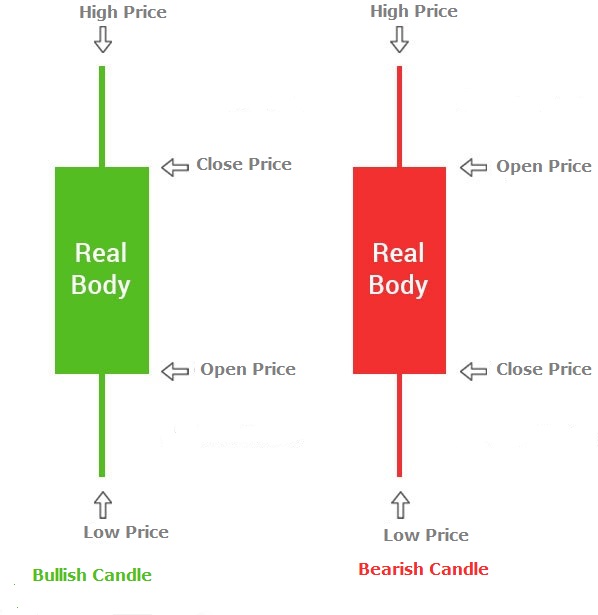

The color of the candle is also crucial in determining which side (bulls or bears) is in control. A long green candle with a large real body signals bullish sentiment, indicating that buyers are in charge. Conversely, a long red candle represents a bearish signal, suggesting sellers are in control. A short daily candle with little or no wick suggests limited price movement during that period.

A strong uptrend or downtrend is visible not just from the price direction but also from the color of the candles. This simple visual representation helps you understand the price action and gain insight into whether buyers or sellers dominate the market.

Overall, candlestick charts effectively depict the ongoing battle between bulls (buyers) and bears (sellers) over a given period, offering a clear view of market sentiment.

Reversal Patterns

A series of candlesticks forms various chart patterns that are easy to recognize while trading in the financial market.

For example, a strong upward or downward movement is clearly visible due to the colors and size of the candlestick body. These visual cues help traders time their entry and exit points more effectively.

Certain candlestick patterns, such as Hammer, Shooting Star, Hanging Man, Doji, Dark Cloud Cover, Inverted Hammer, Morning Star, Evening Star, Engulfing, and Abandoned Baby, are particularly useful for identifying potential trend reversals. These patterns can signal a change in direction, either from an uptrend to a downtrend or vice versa, helping market participants make more informed trading decisions.

Leading Indicators

Candlestick charts are considered powerful leading indicators because they can signal potential reversals earlier than other technical indicators. This makes them a reliable tool for predicting market action ahead of time.

When used alongside other indicators, candlesticks can help identify market moves before they become obvious. The location of the pattern formation can reveal whether the pattern is likely to be a continuation or a reversal pattern.

As a leading indicator, candlestick patterns can assist in the following:

- Trade setups: Helping traders identify opportunities for entering or exiting positions.

- Market direction: Indicating whether the market is trending up or down.

- Optimal entry and exit points: Providing insights into the best times to buy or sell for maximum profit.

Candlestick Chart Patterns to Understand Price Action

To trade or invest effectively using candlestick charts, you must have a solid understanding of candlestick chart patterns.

Before diving into these patterns, it’s essential to first understand the basic construction and use of candlesticks. Candlestick patterns are formed using one or more candles arranged in a specific sequence.

If the components of a candlestick are considered the “bones,” then the patterns represent the heart and soul of price action.

Different chart patterns can give you valuable insights into what might happen next with a security. These patterns can indicate when a trend reverses or when it is likely to continue. Understanding these patterns in the broader market context helps traders decide when to enter a trade, when to exit, and whether to continue a position or close it.

There are over 200 candlestick patterns, but to effectively understand price action using candlestick charts, it’s important to focus on a few key patterns.

The most important signals that you will most often witness are;

- Shooting star

- Morning Star

- Abandoned baby

- Bullish and Bearish Engulfing pattern

- Inside Bar or The Harami

- Doji

- Spinning Tops

- Hanging Man

- Hammer

- Inverted Hammer

- Dark cloud cover

- Bullish piercing line

- Three inside up/down candlestick pattern

- Three outside up/down candlestick pattern

It’s important to note that it’s very rare to encounter a textbook definition of a candlestick pattern in live market conditions. Patterns may have minor variations depending on the current market conditions. Therefore, you need to be flexible and adaptable when analyzing chart patterns, as they may not always appear exactly as described in books or guides.

Alternatives to Candlestick Charting

Traders have several chart types to choose from when analyzing the market. When considering alternatives to candlestick charting, there are two main contenders:

Line Charts

A line chart simply displays the closing price of a security over time. While it provides a clear, straightforward view of price movement, it lacks important details such as open, close, high, low, price gaps, momentum shifts, or session-to-session trading range. Because of this, relying on a line chart to create a trading strategy can be limiting and less effective.

Bar Charts

Bar charts offer more information than line charts. Each bar represents the price range for a specific period, with the top showing the high, the bottom showing the low, and a horizontal line indicating the open and close prices. While bar charts are more informative, they are often replaced by candlestick charts since it takes more effort to identify trend direction and momentum strength on bar charts.

Other Charting Styles

In addition to line, bar, and candlestick charts, there are other charting styles to represent price action, including:

- Point and Figure

- Renko charts

- Heikin Ashi

- Area charts

- Kagi charts

Many traders prefer candlestick charts because they are more visually appealing and easier to interpret. They allow for a clear comparison between open and close, as well as high and low prices, making it simpler to identify trends and price action.

Before applying candlestick patterns in real trades, it’s important to practice identifying and trading them on a demo account to gain confidence and experience.

Disclaimer: In addition to the disclaimer below, please note, this article is not intended to provide investing or trading advice. Trading in the stock market and in other securities entails varying degrees of risk, and can result in loss of capital. Most investors and traders lose money. Readers seeking to engage in trading and/or investing should seek out extensive education on the topic and help of professionals.