Partnership firm in India are governed by Partnership Act, 1932. In India anyone can form partnership firm either by writing a partnership agreement or by oral.

For income tax purpose, partnership firm has to submit partnership deed as a proof of its existence along with PAN card application form 49A.

Before applying you need to make sure that partnership deed is prepared and properly notarized by a notary in India.

Important Points to be Noted in Partnership Deed for Applying PAN

Before applying, we suggest you to cross check following things in the partnership deed to get a PAN card;

- Partnership deed has defined the managing partner and authorized him or her to sign on behalf of partnership firm

- Each and every page of the deed has been signed by both partners and at least by two witnesses.

- Address of the firm has been mentioned in the deed.

- Date of creation of partnership firm or effective date of creation has been mentioned.

After creating partnership deed, a rubber stamp with the name of partnership firm at the top and word partner at the bottom has to be created so that the authorized partner can sign PAN application form and/or other documents as required for business.

With partnership agreement and rubber stamp, now you can apply for a PAN card with income tax department. PAN application can be filled up online or by visiting any authorised TIN FC near to your locality based on your convenience.

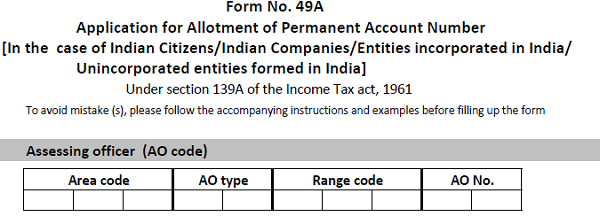

If you are visiting a TIN FC then you will be handed over PAN application form 49A to fill up. You need to fill up following details in black ball point pen. Along with the application form and fee, partnership deed as attested by the managing partner has to be submitted to TIN FC.

- Full name of the firm by selecting title as M/S

- Abbreviation of the name – We recommend to write name of partnership firm. This name will be printed in your PAN card.

- Date of incorporation – Date of partnership agreement as mentioned in Partnership deed

- Office address – As mentioned in partnership deed

- Status of Applicant – Select Partnership firm

- Source of Income – As the main source for a firm is business we recommend to select Income from business /profession or else you can select some other as required.

- Business code – You have to select a code based on the business that you are going to carry on. We have mentioned these codes below for your convenience.

- On the last point i.e. documents submitted, it has to be mentioned as partnership deed for Proof of Identity, Proof of Address and Proof of date of birth. If your firm is registered with the Registrar of Firms then copy of certificate of Registration issued by the registrar of firm has to be attached in place of Partnership deed.

The fee for processing PAN application for a partnership firm is Rs 105.00 (Rs 93.00 + 12.36% service tax).

In the declaration part, the managing partner has to write his or her name, in the capacity of field as Managing Partner, place and date as the date of signing the PAN application form. This means if managing partner Mr XYZ is signing declaration form in Chennai on 1st January of 2015 then the declaration should be like this;

I/we XYZ, the applicant, in the capacity of managing partner do hereby declare that what is stated above is true to the best of my/our information and belief.

Place: Chennai

Date: 01 01 2015

In the signature section, the managing partner has to sign with the rubber stamp of partnership firm (as discussed above). On the top front page of form 49AA, you will find two sections to paste photo and to sign. In both the places managing partner need to sign with the rubber stamp. Photos are not required to paste in case of partnership firm.

In general, PAN card for a partnership firm gets delivered within 15 days from the date of application. You can track your PAN application status online with the help of acknowledgement that TIN FC would have issued after handing over the PAN application form with the fee of Rs 105.

Business or profession code to be selected for PAN application form 49A

| Code | Business/ Profession |

| 01 | Medical Profession and Business |

| 02 | Engineering |

| 03 | Architecture |

| 04 | Chartered Accountant/Accountancy |

| 05 | Interior Decoration |

| 06 | Technical Consultancy |

| 07 | Company Secretary |

| 08 | Legal Practitioner and Solicitors |

| 09 | Government Contractors |

| 10 | Insurance Agency |

| 11 | Films, TV and such other entertainment |

| 12 | Information Technology |

| 13 | Builders and Developers |

| 14 | Members of Stock Exchange, Share Brokers and Sub-Brokers |

| 15 | Performing Arts and Yatra |

| 16 | Operation of Ships, Hovercraft, Aircrafts or Helicopters |

| 17 | Plying Taxis, Lorries, Trucks, Buses or other Commercial Vehicles |

| 18 | Ownership of Horses or Jockeys |

| 19 | Cinema Halls and Other Theatres |

| 20 | Others |

I want to have partnership for making PAN Card. So, pls tell the process for follow this programs.

Dear Sarfaraz Khan,

First of all you have to confirm the partners who going to be associate with you in your business. Then the address and other ID proof of both individual partners have to be submit. Later write a partnership deed document in 50INR stamp paper and green legal papers. You must note that the partnership seal and signature of the each individual partner is most important to make the document valid. Once the document process completed you can keep it safe and use the photo copies of the document to get the PAN card

Note: Many partnership deed formats are available online. You can choose one as per the terms and conditions convinience to you.

I want to have partnership for making PAN Card