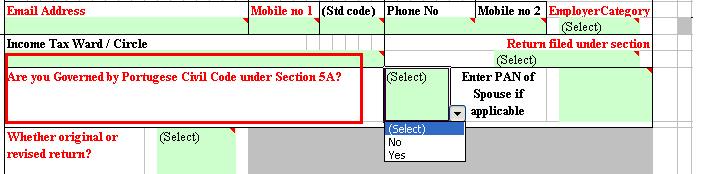

From assessment year 2013-2014 onwards you are required to fill out a column “are you governed by Portuguese civil code” with your answer as yes or no. Without answering this question, the ITR form fill not allow you to proceed.

Same thing is required for assessment year 2014-2015 income tax return forms.

In this article we will let you know income tax provisions for Portuguese civil code and what you need to fill up in your ITR form.

Goa and union territories of Dadra & Nagar Haveli and Daman and Diu were ruled by the Portuguese for more then 400 years. In 1961, these places are liberated by Indian army. After acquiring, still the Portuguese civil law is in existence and applicable to all these places.

What you need to select in Portuguese civil code column for ITR Forms

Section 5A of income tax act, talks about apportionment of income between spouses governed by Portuguese civil code.

According to this section, where husband and wife are governed by Portuguese civil code in force in the state of Goa and in the union territories of Dadra and Nagar Haveli and Daman and Diu, the income of husband and wife shall be apportioned equally between the husband and wife. After apportionment the income shall be included separately in the total income of husband and wife respectively.

However, in case of salary income, it shall be included in the total income of the spouse who has actually earned it from employer and the apportion provision of Portuguese civil code will not be applicable to salary income.

While filling your income tax return, if you are from Goa or union territories of dadra and nagar haveli or daman & diu and covered under Portuguese civil code then select YES. Or else simply select NO and proceed in filling your income tax return.

For salaried individuals coming under the portuguese civil code, does the tax exemption on Housing loan EMI get divided between spouses even if only one of them is actually taking the loan ?