As we all know, from assessment year 2013-2014 onwards, tax audit report as required under section 44AB is required to be filled electronically. Here in this article we will be discussing how to electronically file these tax audit reports.

Section 44AB tax audit report filling steps

Before we start the process or procedure of e-filing tax audit report, please remember that only a chartered accountant having a certificate of practice can only do tax audit as required under section 44AB of income tax act. Other professionals like company secretary, advocate and cost accountants are not allowed to do section 44AB tax audit.

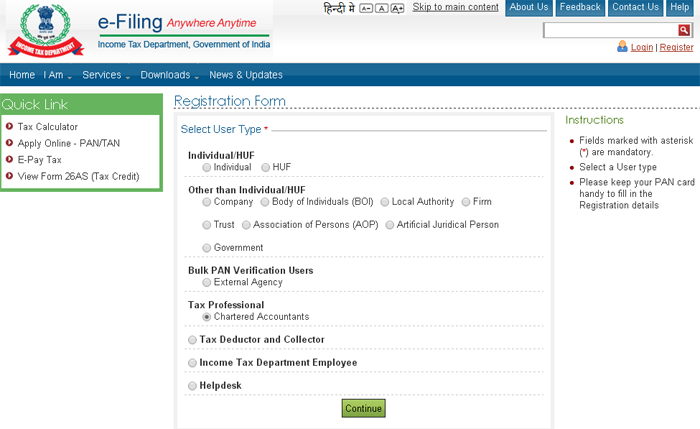

To file these tax audit reports, the chartered accountant in practice is required to get himself registered first as a chartered accountant with the income tax efilling site.

In the process of registration, the chartered account is required to provide his or her membership number, enrollment date and other details like PAN number, DSC and email ID.

After completion of registration, an activation link will be delivered to the chartered accountant’s email ID. After activation user ID will be generated and activated with the password that is selected at the time of registration.

In the second step, assessee or the person who want to carry on audit is required to get registered with the PAN number and other details like date of birth or date of incorporation. After registration, user ID as PAN number and password will be activated.

Now in the third step, the taxpayer who wants to do tax audit is required to add the chartered accountant, who is required to do audit under section 44AB.

To add, go to My account and then select Add CA. A new form will be opened up with options like membership number, form names and assessment year.

Fill up these details and click on submit. Only thing that is required to remember is that the name of the charted accountant who will be doing audit reflects after entering the membership number.

In the fourth step, the chartered accountant is required to download forms i.e. form 3CA or 3CB and form 3CD which is required based on the type of business or profession the assessee is carrying on.

Fill up these forms and generate XML format of the form at income tax efilling website. These XML forms with financial statements in PDF format has to be uploaded by the charted accountant by using his or her logins that is created after registration as a chartered accountant.

In the fifth or final step, assessee is required to approve these uploaded tax audit report from his or her login. After logging in, taxpayer can find this option under the head work list. Now assessee can approve or reject tax audit report that is uploaded by the chartered accountant.

In case these audit reports are rejected by the assessee then the whole process of uploading and approval has to start again.

If assessee has approved it then the process of filling tax audit report is over.

Please remember that tax audit report has to be approved by the assessee or taxpayer before the due date of filling tax audit report. Otherwise, it will be treated as tax audit report has never been filled.

Also Read: